Driving Compliance and Trust in Web3 through Data

Enhancing the security, compliance, and transparency of blockchain

Online Gambling

Money Laundering

Dark and Grey Industries

Amount

Address

Real-time Monitoring Data of Risky Funds in TRON Network

PRODUCT

REQUEST A DEMO

SERVICE

ASSISTANCE

CASE

Wallet Service

Criminal Gangs Creating and Distributing Fake Client Apps Resulting in Extensive User Asset Loss

More

+

+

DeFi Platform

In October 2022, a decentralized exchange protocol fell prey to a hacker and imitators due to a smart contract code vulnerability. Numerous...

More

+

+

CeFi Platform

A cryptocurrency quantitative trading team discovered instances of employees exploiting their positions to embezzle company cryptocurrency ...

More

+

+

INSIGHTS

Casinos and cryptocurrency: major drivers of money laundering, underground banking, and cyberfraud in East and Southeast Asia

More+

Bitrace report zeroes in on stablecoin money laundering methods

More+

3 unique ways hackers are stealing your crypto: Bitrace Report

More+

Bitrace: Beware as Trading Platforms Launch Web3 Wallets, Intensifying Cryptocurrency Fraud Risks

More+

Over 115 Billion USDT Used in Southeast Asia's Illicit Activities in 2022: Revealed Bitrace

More+

Connecting Chinese and American Scam Victims

More+

PARTNER

ABOUT

Investigation

Monitoring

Audit

Advisory

Driving Compliance and Trust in Web3 through Data

Enhancing the security, compliance, and transparency of blockchain

Real-time Monitoring Data of Risky Funds in TRON Network

Online Gambling

Amount

Address

Money Laundering

Dark and Grey Industries

PRODUCT

01

Detrust

A Blockchain Risk Fund Monitoring and Management Platform

Risk Data Perception

Utilizing risk rule engines and AI recognition engines, DeTrust can identify risks such as fraud, theft, money laundering, ransom, terrorism, and illegal online gambling associated with relevant risk addresses. It also can timely push multi-chain risk fund alerts to help clients avoid real-time business compliance risks and build an anti-fraud security line.

Risk Event Management

Clients can manage risk events, including self-checks and platform intelligent recognition, by tracking progress and fully recording investigation results. DeTrust can invite multiple parties to collaboratively promote risk event investigation, interception, freezing, and recovery.

Risk Dynamic Monitoring

Based on on-chain KYT, KYA, and KYC capabilities, DeTrust assists clients in completing pre-transaction risk investigations and post-transaction continuous monitoring of fund movements. It also supports customizable risk control strategies to achieve compliance checks on fund inflows and outflows.

REQUEST A DEMO

02

Bitrace

Pro

Pro

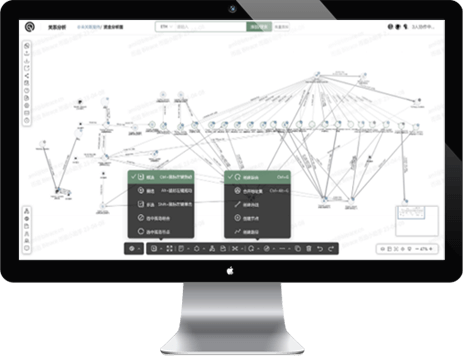

A Crypto Tracking and Analysis Platform

Intelligent Analysis

Bitrace Pro has functions such as transaction queries, visual analysis, entity recognition, and address clustering for mainstream currencies like BTC, ETH, USDT-ERC20, USDT-TRC20. Equipped with over 20 common risk intelligent analysis models, it can easily track transactions and assist clients in quickly reconstructing risk events and conducting fund analysis.

Multi-Part Collaborations

Bitrace Pro addresses the need for collaborative analysis and investigation in events such as hacking and theft, internal occupational crimes, etc. It also has functions such as canvas sharing, address labeling, intelligence interaction, and multi-task management to facilitate efficient collaborative analysis based on a visual canvas.

Entity Identification

Based on machine learning and pattern recognition algorithms, Bitrace Pro has accumulated a database of over 300 million address labels. This includes entity labels (DeFi platforms, mining pools, digital asset exchanges, etc.) and risk behavior labels (fraud, terrorism, drugs, illegal online gambling, money laundering, gray and black production). It can helps clients quickly identify the actual controllers behind addresses or the purpose of addresses.

SERVICE

01

Investigation

We have extensive experience in conducting investigations, evidence collection, analysis of criminal methods and motives, on-chain tracking and analysis, and assisting clients in coordinating with law enforcement agencies to successfully recover assets. We work closely with our partners to block risk funds and improve the success rate of asset recovery. Additionally, we have long-term partnerships with renowned law firms to assist clients with legal matters related to cryptocurrency crime events, providing professional legal services and helping clients recover their assets through legal channels.

Incident Response and Consultation

We work with clients to clarify the details of the incident, analyze the relevant addresses and fund flows, and provide guidance on protective measures to prevent further losses.

Fact Investigation and Evidence Collection

We evaluate the criminal methods and on-chain fund flows involved in the incident, assist clients in conducting initial investigations of relevant evidence and data, and prepare preliminary incident reports and preserve relevant electronic evidence.

Asset Interception and Recovery

We continuously monitor the compromised assets and establish immediate linkage with service providers including exchanges and SWAP platforms to intercept and block the assets.

Judicial Assistance

We collaborate with renowned law firms to assist clients in addressing legal issues related to the incident, facilitate communication with law enforcement agencies, and increase the likelihood of successful asset recovery.

ASSISTANCE

02

Monitoring

We provide continuous monitoring of fund inflows and outflows from our clients' business addresses, identifying alerts for illegal activities such as fraud, money laundering, theft, extortion, terrorism, and cryptocurrency funds related to online gambling. We assist clients in implementing timely risk control measures.

Address Monitoring

We daily monitor the provided and confirmed main business addresses of our clients and provide regular summaries and feedback on the monitoring results.

Alert Triggers

We trigger alerts when monitored addresses show signs of funds related to criminal activities, suspicious funds from grey/black markets, abnormal anonymous outflows, or attempted interaction attacks.

Risk Control Intervention

After a risk is triggered, we generate risk reports and collaborate with our partners to implement risk control measures to address abnormal fund outflows. We also provide recommendations and solutions for risk response and disposal.

03

Audit

We conduct comprehensive and in-depth analysis of our clients' business addresses, including fund composition, risk counterparties, and associations with various illegal activities. This helps clients understand the criminal risks associated with their business addresses and effectively isolate risk funds without impacting business operations, thus enhancing compliance with regulations.

Business Evaluation and Project Planning

Determining the scope of the audit and project plan.

Understanding clients' business background and models.

Analyzing clients' needs for fund risk audit.

Compliance Risk Assessment and Identification

Conducting a comprehensive analysis and identifying potential fund compliance risks and weak risk control areas.

Drafting a fund compliance audit report, including a summary of major fund risk issues and improvement recommendations.

Delivery and Interpretation of Audit Report

Providing a detailed interpretation of the report to ensure clients fully understand the audit results.

Offering follow-up support to ensure effective implementation of improvement measures and enhance the level of digital currency compliance and risk control.

04

Advisory

Enforcement Relationship Advisor

Based on experience in coordination with law enforcement agencies in China, China Hong Kong, the United States, Seychelles, India, Germany, Canada, and other countries, we assist clients in managing their relationships with various law enforcement agencies. We provide consulting and advisory services on process management, legal compliance, information security, and other aspects related to law enforcement requests and engagement.

Compliance Advisor

Through in-depth research on regulatory policies and compliance in the cryptocurrency industry across different countries, we collaborate with global law firms, universities, and professional consulting organizations to address clients' needs in cryptocurrency business compliance and government relations. We assist clients in effectively navigating regulatory authorities, providing services such as monitoring policy changes, interpretation, recommendations, and strengthening communication and trust between clients and regulatory bodies. Our aim is to help clients mitigate the risk of regulatory penalties resulting from compliance issues.

CASE

Wallet Service

Criminal Gangs Creating and Distributing Fake Client Apps Resulting in Extensive User Asset Loss

More

+

DeFi Platform

In October 2022, a decentralized exchange protocol fell prey to a hacker and imitators due to a smart contract code vulnerability. Numerous...

More

+

CeFi Platform

A cryptocurrency quantitative trading team discovered instances of employees exploiting their positions to embezzle company cryptocurrency ...

More

+

INSIGHTS

Casinos and cryptocurrency: major drivers of money laundering, underground banking, and cyberfraud in East and Southeast Asia

More

+

Bitrace report zeroes in on stablecoin money laundering methods

More

+

3 unique ways hackers are stealing your crypto: Bitrace Report

More

+

Bitrace: Beware as Trading Platforms Launch Web3 Wallets, Intensifying Cryptocurrency Fraud Risks

More

+

Over 115 Billion USDT Used in Southeast Asia's Illicit Activities in 2022: Revealed Bitrace

More

+

Connecting Chinese and American Scam Victims

More

+

PARTNER

About Us

Bitrace is a blockchain data analysis company that provides leading tools and services that focus on cryptocurrency data analysis, risk management, and enforcement collaboration compliance to regulatory and law enforcement agencies, financial institutions, and Web3 enterprises.

We aim to leverage data analysis technology to identify illicit cryptocurrency funds and, by establishing a collaborative platform, excavate, alert, intercept, and recover criminal funds. Our mission is to enhance the transparency, compliance, and security of blockchain applications, fostering mutual trust and transparent collaboration among governments, institutions, and businesses. We strive to assist governments and enterprises in jointly addressing regulatory and compliance challenges, promoting compliance within the Web3 industry, and facilitating its rapid development.

ABOUT